The Basic Principles Of Finance

Wiki Article

The 25-Second Trick For Finance

Table of Contents10 Simple Techniques For FinanceThe Basic Principles Of Finance What Does Finance Mean?The 9-Minute Rule for FinanceThe Ultimate Guide To FinanceAll About Finance

If you expect to shed money for the first year, you clearly won't be able to settle an one-year funding in a timely manner. You would certainly be better off with intermediate or long-lasting financing. You need to think about amortization Schedule through which you'll minimize the equilibrium of your debt.the timetable by which you'll minimize the balance of your financial debt.

The price of rate of interest charged on a lending varies with several factorsthe general level of rate of interest, the size of the funding, the high quality of the collateral, and the debt-paying ability of the borrower. For smaller sized, riskier loans, it can be as high as 6 to 8 portion points over the prime ratethe price that banks bill their most creditworthy customers.

An Unbiased View of Finance

Regrettably, she desired the whole lending secured. Due to the fact that you're utilizing several of the car loan cash to buy washers and also dryers (for $15,000) and also a truck (for $6,000), you can set up these as collateral. You have no receivables or inventories, so you accepted install some personal assetsnamely, the shares of Microsoft supply that you obtained as a high-school graduation existing (currently worth regarding $5,000).You had your predicted five hundred clients within 6 months, as well as over the following few years, you expanded to 4 other colleges in the geographical location. Process of keeping track of cash inflows and also outflows to guarantee that the company has the best amount of funds on hand. When forecasted cash money flows suggest a future scarcity, you go to the financial institution for added funds.

The Greatest Guide To Finance

You take care to pay your costs promptly, yet not beforehand (due to the fact that it remains in your benefit to hold on to your cash as long as possible). A budgetA document that itemizes the income sources and also expenditures for a future duration (usually a year). is an initial financial plan for an offered amount of time, usually a year.You fear to expand better, yet to do that, you'll need a substantial mixture of new cash money. You've put the majority of your revenues back into the company, and also your parents can't lend you any type of even more cash. After giving the trouble some idea, you realize that you have 3 choices: Ask the financial institution for even more cash.

The Ultimate Guide To Finance

Your growth begins. Fast-forward another five years. You have actually worked tough (and also been fortunate), as well as also complete your degree in money. Your firm has done remarkably well, with procedures at even more than 5 hundred colleges in the Northeast. You have actually funded proceeded strong development with a mix of venture-capital funds as look at more info well as internally created funds (that is, reinvested incomes).Because you expect your recommended you read service to thrive also more as well as expand also larger, you're thinking regarding the possibility of offering supply to the public for the first time. The advantages are eye-catching: not just would you get a big increase of cash, yet because it would certainly originate from the sale of stock instead of from loaning, it would likewise be interest totally free and you wouldn't have to repay it.

Second, from this point on, your financial outcomes would certainly be public info. You 'd be responsible to shareholders that will certainly want to see the kind of short-term efficiency results that increases supply costs.

The Finance Ideas

Economic organizations supply company lendings with various. A grows in much less than a year, an in one to 5 years, as well as a after 5 years or even more. Banks additionally issue that permit business to borrow up to a defined amount as the demand emerges. Financial institutions normally require in the form of, such as firm or individual possessions.Existing firms that want to increase often look for financing from private capitalists. are wealthy people that are prepared to buy ventures that they believe will succeed., though eager to invest larger sums of money, frequently intend to squander quicker than angels. They generally purchase existing organizations with strong growth capacity.

It must consist of all the following items: Sources of all funds Dollar totals up to be gotten via each source Find Out More The maturity, annual rate of interest, and also protection of any loan The overall of your resources have to equal $500,000. Finally, compose a quick report explaining the aspects that you considered in getting here at your combination of resources.

The Definitive Guide to Finance

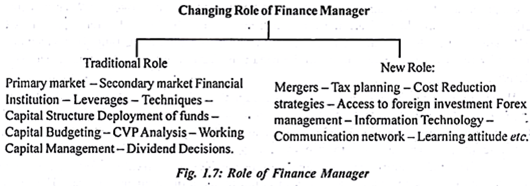

To see whether this option makes good sense, research study the advantages and disadvantages of obtaining funding from a venture plutocrat. Create a quick record describing why you have, or haven't, made a decision to look for private financing.The function of the finance supervisor has long been one of the vital functions at any organisation operating with substantial turnover. The duty is an extremely common location for those in the monetary area as well as for those with a solid understanding of numbers and excellent analytical and also communication abilities might be the excellent task.

Report this wiki page